Ever Wondered How Money Gets Transferred Around the World?

Being able to transfer money around the World, simply, cheaply and securely is at the core of what LinealPay does, but have you ever wondered how it works?

The vast majority of money moves around the World through the Banking System. The term ‘moves’ however is possibly a little misleading. In truth very little money ever moves internationally and instead is a flow of ledger entries between trusted counterparts who hold accounts with each other.

Whilst in Southern Asia the use of money couriers is still used and the Hawala system of inter-connected agents, which originated in India in the 8th century, remains popular in areas such as the Horn of Africa, particularly Somalia, an estimated $140trn was moved internationally through the Banking System in 2020 [Source: Ernst & Young]. The Bank of England estimate that this will rise to more than $250trn by 2027.

So how does this all work?

Domestic Payments

Let’s start by looking at the domestic system, so that we can see how money transfers work. Domestic systems are referred to as ‘closed loop’ as they are not connected to other non-domestic systems but work much in the same way.

Banking is based on trust and in the case of the UK Banking System, the Bank of England to maintain regulatory standards and act as the guarantor, or ‘Lender of Last Resort’ as it is often referred.

You may have heard of several terms and acronyms such as BACS, CHAPS, Faster Payments, and Target 2 and SEPA in the EU.

Money moves between banks either through, what is known as Real Time Gross Settlement [RTGS], such as CHAPS or through aggregated netting between Bank members, such as BACS.

BACS stands for ‘Bankers Automated Clearing Services’. BACS payment services are operated and managed by the BACS Payments Scheme Limited, a membership organisation consisting of 16 of the UK’s leading banks. In 2020 there were 4.5 billion payments made by Direct Debit, basically a pull or demand, and almost 2 billion Direct Credit payments, a push. A BACS transfer works on an aggregated netting system and usually takes between 1 and 3 days to settle.

Alongside this, bank-to-bank payments can also be made through Faster Payments and CHAPS. Faster Payments allows for near real-time payments between bank accounts in the UK, although they are processed through the same BACS system. The key being the trust relationship between financial institutions. Meanwhile, CHAPS is a same-day payment method for high value transactions (e.g., for buying property).

Both RTGS and Aggregated Netting work essentially in the same way. Money is debited from Account A, with say Lloyds, and credited to Account B with NatWest. The difference being that behind-the-scenes payments through RTGS is an individual transaction whilst with aggregated netting the total value of transactions between individual banks is pooled and netted off after banking hours, hence the slower settlement times.

So, to summarise, there are essentially two-ways in which money moves through the domestic banking system either RTGS or Aggregated Netting. The same applies Internationally. The key being the trust that exists or is created between counter parties.

International Payments

Domestic payment systems are not directly connected with the systems of other countries so when making a transfer between two jurisdictions, the currency is not physically transferred overseas.

Instead, international banks provide accounts for foreign counterparts and have their own accounts with their foreign counterparts, which enable banks to make payments in foreign currency. The funds are not sent across borders; accounts are credited in one jurisdiction and debited the corresponding amount in the other. The so called ‘nostro’ and ‘vostro’ relationships, literally ‘ours’ and ‘yours’.

Other payment providers such as Fintechs and money transfer agents use this interbank network to provide payment services to businesses and individuals. So, when sending money via a Fintech, like LinealPay, it is just as safe as any other means.

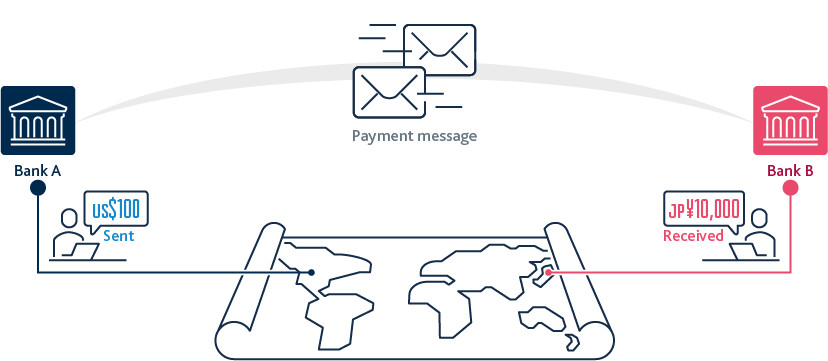

For example, in Figure 1 Bank A will send a message to Bank B instructing them to make a payment for a customer. Bank B will then credit the end customer’s account with money from the account Bank A holds at Bank B.

Figure 1: A simple cross-border payment using accounts held at each bank

A payment message sends an instruction to debit an account in Bank A and credit an account in Bank B

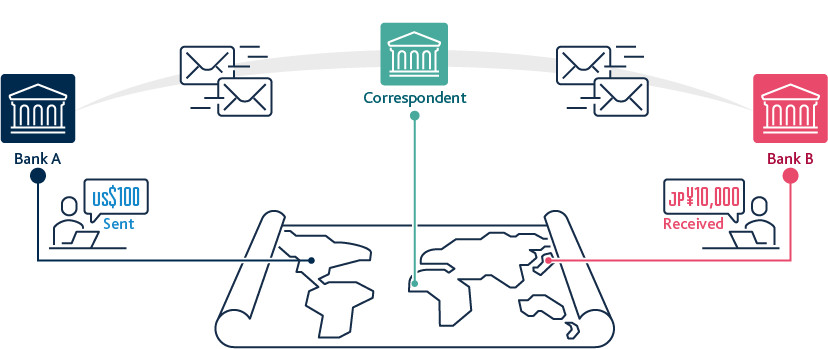

However, not every bank has a direct relationship, so sometimes they need to transact via an intermediary, a ‘correspondent’ bank. This is a bank which provides accounts for Bank A and Bank B if they do not have a direct relationship with each other. This is known as correspondent banking and is an essential component of the global payment system for cross-border transactions. It is based around the trust between parties.

Figure 2: A cross-border payment using a correspondent bank

Bank A and Bank B do not have accounts with each other, so they use a bank where they both hold accounts — the correspondent bank.

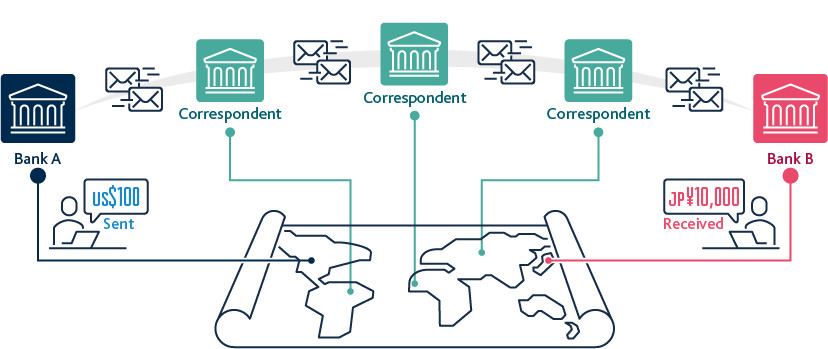

The more intermediaries that are involved in a cross-border transaction, the slower and more expensive it will be. For currency pairs with high volumes of payments (for example, US dollar to British pound sterling), there will usually be a shorter chain. But for conversions between currencies with a lower volume of payments there are more correspondent banks involved. The more correspondent banks involved the longer the transaction will take, and more costs will be involved at each stage of the chain. The set of payment flows between one country and another is referred to as the ‘country corridor’ or ‘payment corridor’.

Figure 3: Cross-border payment using the correspondent-banking network

The less common the currency pair, the more correspondent banks will be required to make the payment, incurring costs and delays at each stage.

At each bank in the chain, fees will be taken for processing and foreign exchange, the payment messages will need to be checked against local financial crime requirements and each bank will need to update the balances in the accounts of the incoming and outgoing payees using their domestic payment systems which are only open during normal business hours. The sender’s bank will need to hold enough cash to cover these unknown costs until the payment is complete.

SWIFT

SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication.

It’s an organisation that was founded in Brussels in 1973 to establish some common processes and standards for financial transactions. A co-operative of banks and financial institutions with over 11,000 members.

SWIFT is the main way in which international money transfers are instructed and recorded. Upward of 20 million payment instructions pass through the network each day.

SWIFT does not facilitate funds transfer, rather, it sends payment orders, which must be settled by correspondent accounts [as illustrated in Figures 1,2 and 3 in the last section] that the institutions have with each other. Each financial institution, to exchange banking transactions, must have a banking relationship by either being a bank or affiliating itself with one (or more) to enjoy those particular business features.

The most up to date version of the SWIFT payments protocol is known as SWIFT Gpi [Global Payments Initiative]. According to SWIFT roughly 4,000 of its 11,000 members are currently connected to the network.

LinealPay uses SWIFT Gpi as the main means to transfer funds around the World as well as a number of Automated Clearing House [ACH] payment corridors through links with international banks enabling access to domestic payments systems.

About LinealPay

LinealPay is a UK Fintech specialising in international payments and deliverable foreign exchange.

We make transfers in 35+ currencies and once in possession of cleared funds can be up to 90% cheaper than the high street banks. You’ll enjoy 24-hour delivery to 200+ destinations and same day delivery on many currencies including US & Canadian Dollars, Indian Rupees, Euros and Swiss Francs.

In fact, 94% of payments are delivered in hours rather than days and some payments to the EU from the UK can be made in just seconds. Importantly, when the occasional glitch occurs, or you need expert advice, we have people on hand to sort the matter out or provide guidance.

Our vision is to help make global business payments simple, cheap and secure, to connect you to more of the World and more of the World to you, enabling you to access new markets, helping your business grow.

To learn more about LinealPay’s services please visit our website, www.linealpay.com or contact us on 0203 105 9278